Picture this: Your reservoir engineering team has just pitched an AI initiative that could revolutionize your drilling optimization. The potential ROI looks incredible. But buried in the technical details is a decision that could make or break your company's future:

"What subsurface data are you willing to share with external AI platforms?"

If you're like most oil and gas executives, you've probably been swept up in the AI gold rush. Every board meeting features another presentation about ChatGPT, every vendor promises AI will solve your production challenges, and your competitors are making headlines with their "digital transformation" initiatives.

But here's what the consultants aren't telling you: The wrong data decision could commoditize your entire upstream competitive advantage overnight.

The Uncomfortable Truth About AI and Your Reservoir Data

During our recent webinar, two energy experts delivered a wake-up call that should concern every upstream executive.

Al Lindseth (Principal, CI5O Advisory Services LLC), who spent 22 years at Plains All American as Corporate Risk Manager, VP, and SVP, Technology, Process and Risk Management, joined Anup Sharma (Founder and CEO, ASynapse), a former GE and Worley executive with over three decades in heavy industry, to discuss a critical blind spot in corporate AI strategies.

Their message was unambiguous:

"Companies should be really careful and thoughtful about exposing their crown jewel (data) to a large language model because it gets commoditized."

Consider what's at stake. Your seismic interpretations that reveal sweet spots competitors haven't found. Your reservoir models that predict production with uncanny accuracy. Your drilling algorithms that consistently deliver wells faster and cheaper than industry benchmarks. Your completion designs that unlock reserves others can't access profitably.

Every byte of this data represents years of trial and error, billions in capital investment, and hard-won operational knowledge. Yet companies are inadvertently turning this intellectual property into training data for AI systems that will eventually serve their competitors.

This isn't a theoretical concern. Sharma's previous company recognized the threat early and made a strategic decision to build an internal "AI factory" using Nvidia and Dell infrastructure, ensuring their most valuable operational data never left their premises.

The Proven Two-Speed Strategy for Safe AI Adoption

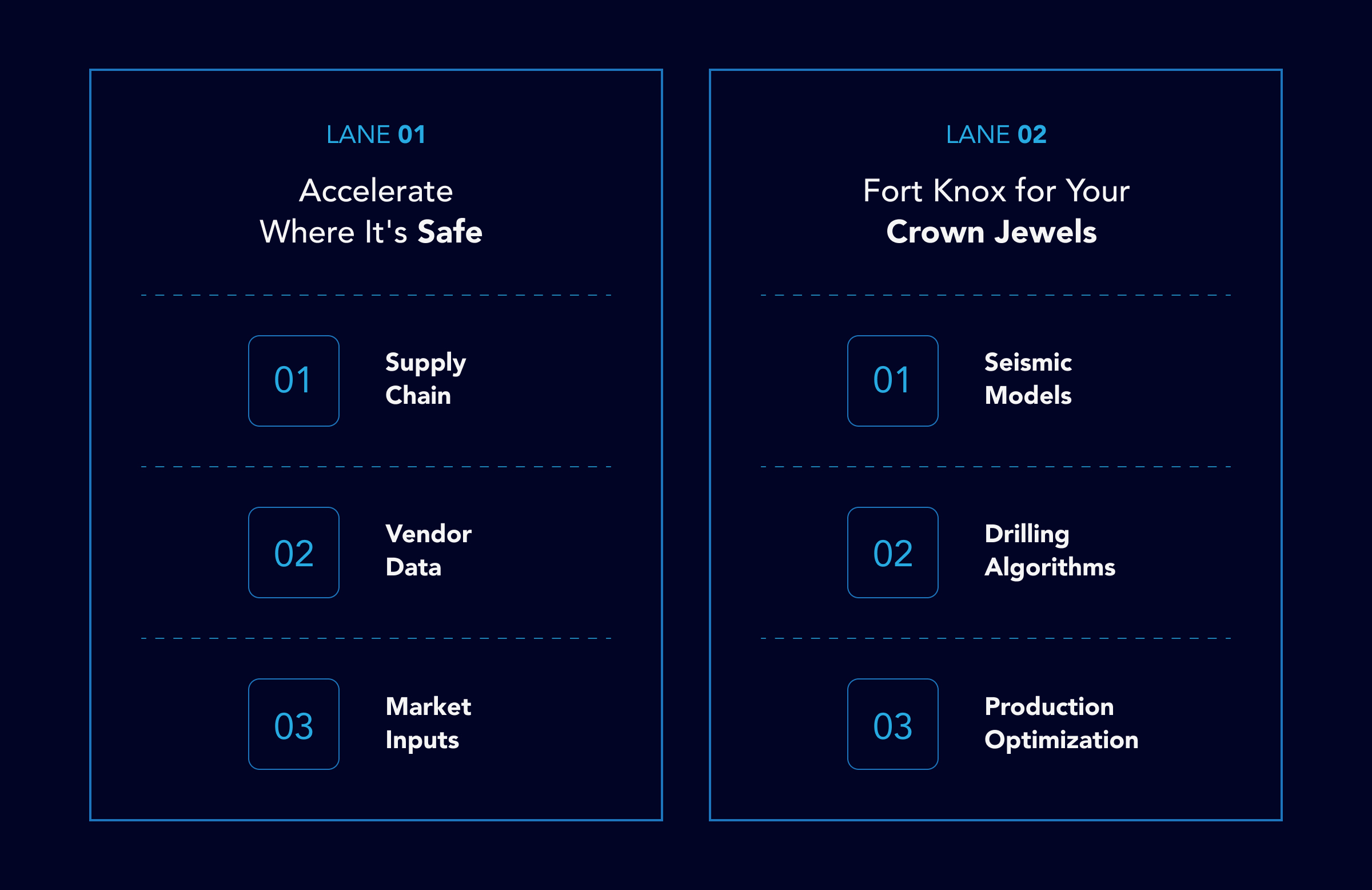

Oil and gas executives don’t have to choose between AI innovation and protecting their most valuable data. Based on years of firsthand experience, Lindseth and Sharma recommend a dual-lane strategy: one lane that accelerates AI where it’s safe, and another that safeguards your crown jewels with the highest level of protection.

Lane 1: Accelerate Where It's Safe

Begin your AI journey with data you already share with external partners. As Lindseth explains:

"A good place to start is supply chain because you naturally share information there. You have governance, you have processes, you have agreements."

This represents enormous untapped potential for oil and gas operators. Supply chain disruptions dominated CEO priorities during COVID and continue to challenge the industry today. Steel tariffs, equipment shortages, and geopolitical tensions create constant uncertainty around everything from drilling rigs to pipeline materials.

AI can transform your approach to supplier risk management, scenario planning, and procurement optimization. The beauty of this approach is that you're using data that's already external facing, eliminating the risk of competitive intelligence leakage while delivering measurable business value.

Lane 2: Fort Knox for Your Crown Jewels

Reservoir characteristics, proprietary drilling parameters, production optimization models, and seismic interpretations represent your competitive moat. These assets demand the highest level of protection.

Sharma's perspective on this is crystal clear:

"This is a boardroom business strategy that gets translated into a data strategy... If you expose some level of information, you could go out of business. This is how powerful this capability is."

This isn't a decision to delegate to IT departments or operations teams. The data strategy that governs your most valuable upstream assets requires C-suite involvement and board-level oversight. The stakes are simply too high to treat this as a routine technology implementation.

This is why the most sophisticated operators apply a simple but powerful framework when evaluating what data to share with external AI platforms:

- The Reservoir Advantage Test - Ask yourself: If this subsurface data became available to competitors, would it erode our drilling or production advantage? If the answer is yes, keep it on-premises.

- The Regulatory Exposure Assessment - Consider not just current regulations but where regulatory scrutiny is heading. Pipeline integrity data, well completion details, and environmental monitoring information all fall under intense regulatory oversight and carry massive liability implications.

- The Asset Protection Principle - Your unique operational insights, including how you optimize production, manage well interference, predict equipment failures, or enhance recovery rates, are asset-level differentiators, not training data.

- Strategic Implementation Support - Leading operators partner with specialized firms (like Aligned Automation) to conduct comprehensive data sensitivity assessments. These evaluations help identify which datasets pose the highest risk if exposed to external LLM models, ensuring that competitive intelligence remains protected while still enabling AI-driven operational improvements. The key is having experts who understand both the technical AI landscape and the strategic value of upstream data assets.

The companies getting this right are building internal AI capabilities for their most sensitive applications while leveraging cloud-based AI for everything else. It's not an either/or decision for oil and gas operators. It's a strategic portfolio approach.

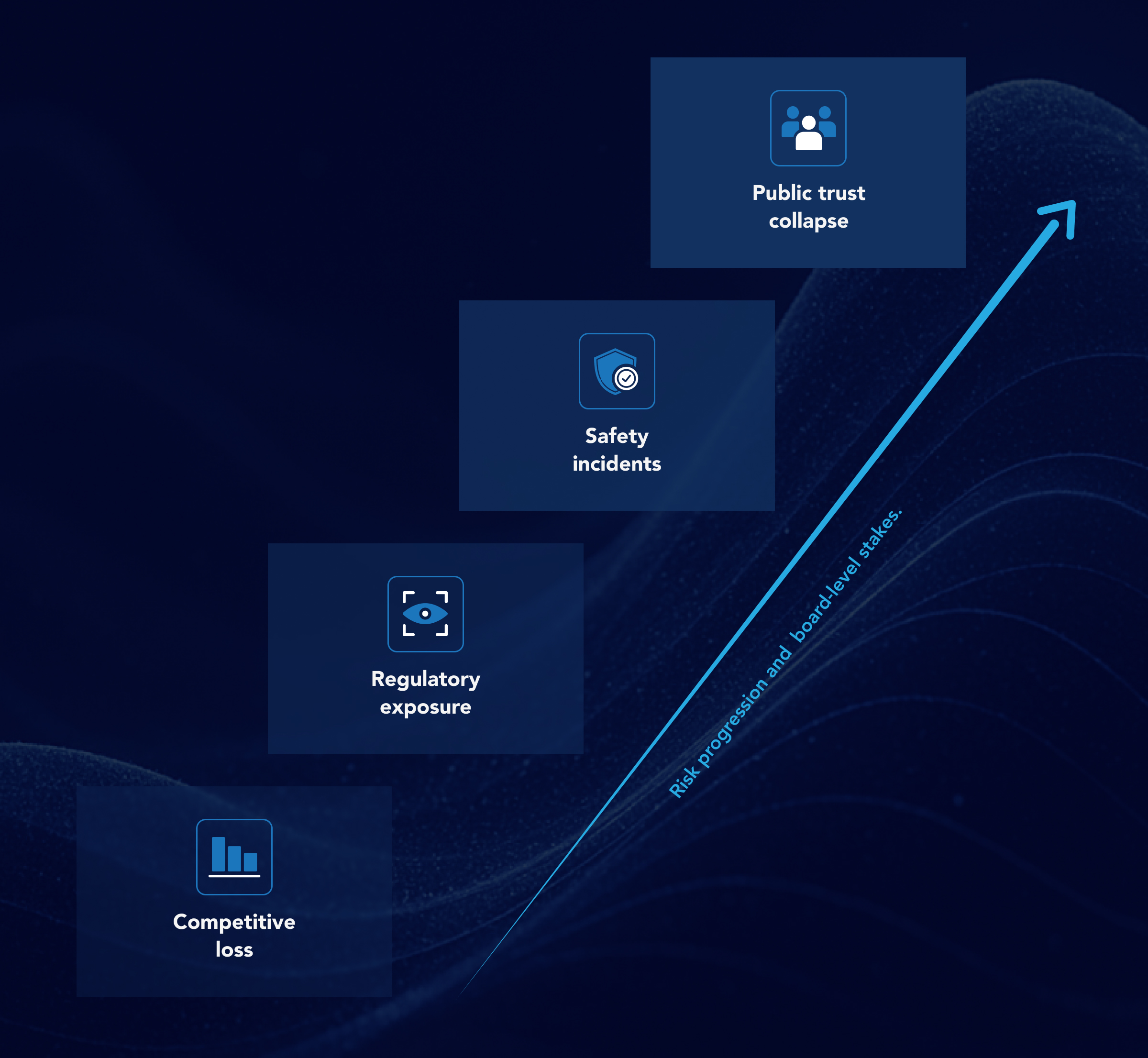

The Real Cost of Getting This Wrong

Beyond the competitive implications, consider the regulatory exposure. Oil and gas companies operate under intense regulatory scrutiny from agencies like PHMSA for pipelines and various state commissions for drilling operations. A data breach involving operational data doesn't just risk competitive advantage, it risks regulatory penalties, safety incidents, and public trust.

Moreover, the AI landscape is evolving rapidly. Today's secure AI partner could be tomorrow's acquisition target. Today's proprietary model could become tomorrow's open-source standard. Building your entire AI strategy on external dependencies creates risks that extend far beyond technology.

These three critical steps separate industry leaders from those who will find themselves disrupted:

- Audit Your Current AI Initiatives: What reservoir data, production data, and operational insights are they using? Where is it being processed? Who has access? You might be surprised by what you discover.

- Develop Your Oil and Gas Data Classification Framework: Not all data is created equal. Create clear categories: public, partner-shareable, and crown jewels including reservoir data, completion designs, and production optimization algorithms that never leave your environment.

- Invest in Internal AI Capabilities: The oil and gas companies winning the AI race aren't just buying AI software, they're building AI capabilities that work with their most valuable subsurface and operational data assets.

AI will transform the oil and gas industry, and it's already happening. The question is whether you'll be the disruptor or the disrupted.

The companies that get the data decision right will unlock AI's transformative power for drilling optimization, production enhancement, and operational efficiency while protecting their subsurface knowledge and operational advantages. Those that don't may find they've funded their competitors' AI advantage with their own hard-won reservoir insights.

Transform Your Ideas into Powerful Digital Solutions

.svg)